Making an application for credit that have several lenders is frequently an indicator you to anyone is having problems obtaining credit on account of a bad history or he or she is within the a monetary problem

Pre-approval (for those which have a home they’d wish to get lined up) or conditional approval (for those who are yet to obtain its fantasy assets) are both beneficial equipment while looking to buy possessions. They are both specialized evidence off exactly how much a lender is happy to loan your, although a good pre-approval will have got significantly more checks over towards chose property, proving the lender are happy with the fresh new hopeful get rather than simply your ability to settle the borrowed funds.

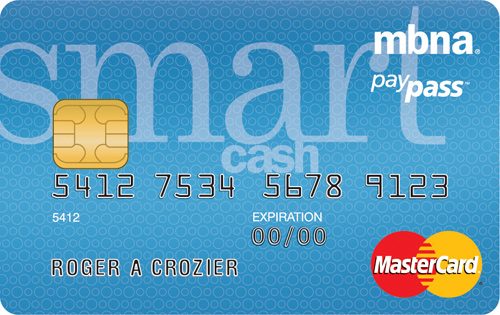

Tough enquiries are those enquiries which have been generated when you get a home loan, car loan otherwise credit card, when you find yourself delicate enquiries are the ones inspections produced by your self, a manager or an insurance company playing with a professional seller, including the of them the subsequent

Pre-approvals and you will conditional approvals commonly guaranteeing, together with lender is not bound by her or him, however with one using your belt you could make told decisions when buying a property. Having good conditional approval, you could work-out just what fits to your funds centered on the conditionally recognized loan amount therefore the mortgage fees plan. Realtors was keen to simply help people who have acquired conditional or pre-recognition since it shows he or she is intent on to get property.

You’ll find different varieties of conditional and you will pre-approvals and a pre-approval isnt limited to home loans. You could apply for a this type of into a consumer loan or auto loan as well. When you have an effective conditional or pre-recognition you will still need certainly to officially submit an application for that loan, very a loan provider is also formally approve the loan number. Whenever they officially agree your application, you’ll encounter last unconditional acceptance from your bank.

Even though an effective conditional otherwise pre-acceptance is not the same as a proper home loan, into the process it is still important online payday loans Alaska for a lender to build an enquiry into the credit file and you can rating, so they can regulate how much they’d become prepared to provide your. This will be titled a cards inquiry and your credit history tend to song the main points of each and every inquiry. Submitted borrowing inquiry details should include the lending company, reason for this new consider therefore the day away from enquiry. Given a cards enquiry belongs to the conditional and you can/otherwise pre-approval procedure, several conditional otherwise pre-approvals have a tendency to end in several borrowing from the bank enquiries and therefore can impact your credit rating. Let us consider as to the reasons.

Credit enquiries belong to a few classes: tough and delicate. Soft enquiries do not perception on your credit rating, but difficult enquiries manage.

A home loan pre-recognition is recognized as an arduous enquiry which can get an enthusiastic impact on your credit rating. You to definitely enquiry by itself is not a detrimental point, but multiple enquiries more than a few days months are. For the reason that multiple difficult enquiries may suggest financial be concerned to help you a lender as they are seen unfavourably. A card enquiry stays in your credit history for 5 ages and you may during those times this may effect on your credit potential.

When shopping for the right monetary device additionally the interest the recommendations will be to store around’, but if you get mortgage pre-approvals the exact opposite is valid. Applying for several conditional or pre-approvals have a terrible influence on your credit score.

Research is nonetheless extremely important, however it ought to be done well before your officially make an application for a great conditional recognition. Good conditional recognition cannot mode section of your quest and you will analysis, alternatively you need to only submit an application for a home loan conditional or pre-recognition once you have selected the ideal financial.