A few of the conditions you to meet the requirements you having good USDA mortgage financing in Michigan become – money, downpayment, credit scores, and much more. Delivering a great USDA mortgage isnt much unique of getting good antique home loan. Listed here are ten circumstances that will feeling the loan approval.

1munity Bank Acceptance which have USDA

USDA are an authorities company that sponsors the application form, but your community lender commonly deal with 100 percent of purchase. It means the people banker do from delivering the application so you’re able to issuing the very last recognition. USDA leaves a last stamp regarding recognition towards financing, as well as that is handled by lender. Vendors normally contribute doing six percent of sales price on the closing costs.

2. Zero Down-payment

The down-payment requirements – otherwise diminished one to ‘s the reason so many customers buy the USDA real estate loan system. No down payment needs, so it’s mostly of the 100 percent funding lenders for sale in the current industry.

You’ve got a down-payment virtue that would capture years having really group to store 5 per cent down or higher. In those days, home values can move up, making saving a deposit actually more complicated. With USDA mortgages, homebuyers can find quickly and take benefit of broadening home thinking. The minimum credit rating having USDA recognition was 640. The latest debtor have to have a rather a good credit score records which have limited thirty day late costs over the last one year.

4. First-Big date Homebuyers

USDA secured mortgage loans aren’t suitable for all customer. However,, any earliest-day or recite buyer trying to find belongings beyond significant towns is to examine its qualifications towards the program. The application is present for purchase deal just, zero capital features otherwise second belongings. A purchaser don’t very own a new family from the time of buy.

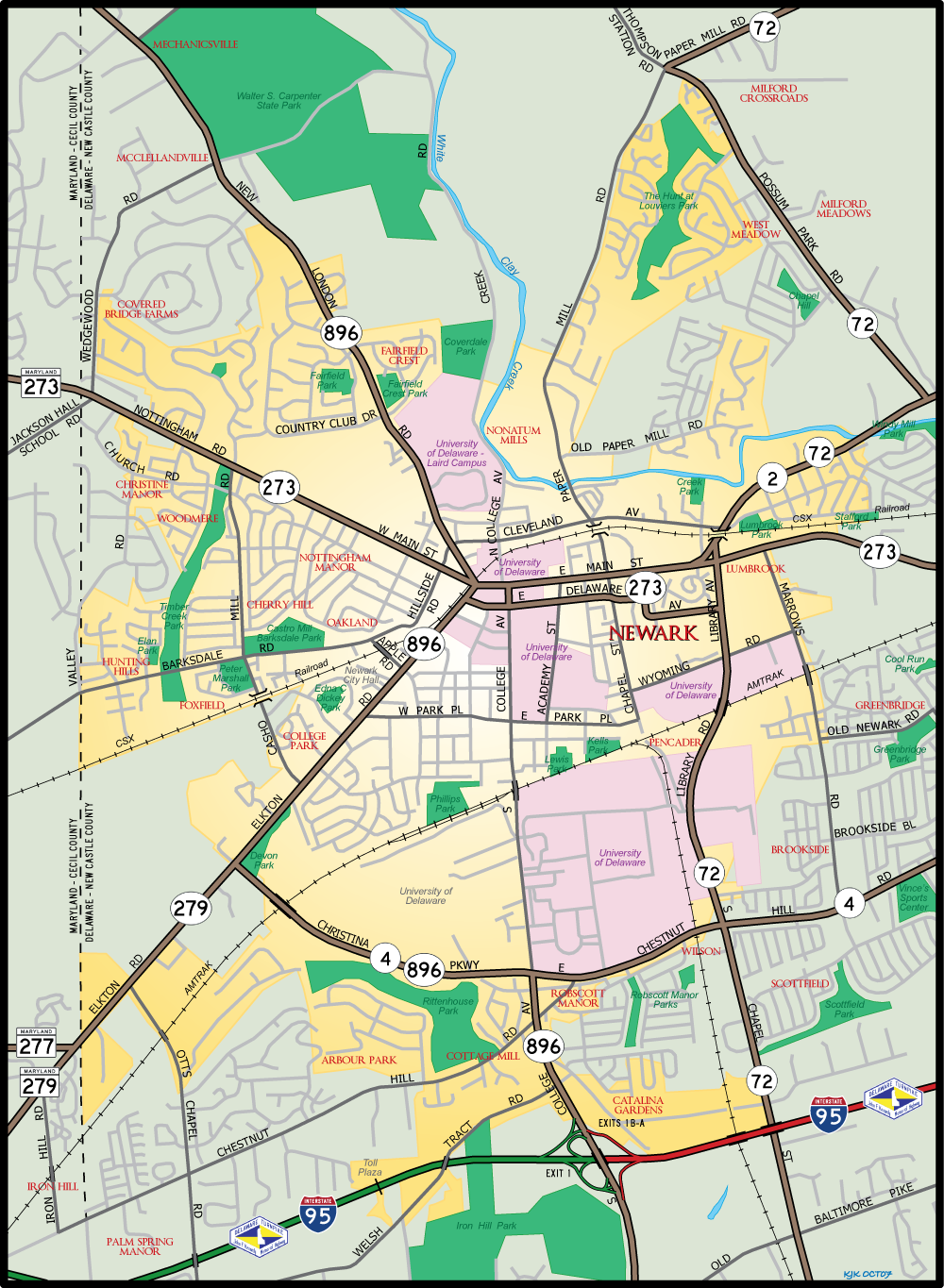

5. Geographic Limitations

Geographic components to possess USDA mortgages try for homes that have to be found in this a USDA-qualified urban area. Getting qualified, property should be inside the an outlying area. Fundamentally, locations and you will towns having a population less than 20,000 be considered.

six. Appraisal and you will Property Requirments

An assessment to your possessions to decide the worth becomes necessary. The fresh appraisal declaration in addition to verifies our home try livable, secure, and matches USDA’s minimal property requirements. One safety or livability circumstances will need to be corrected just before mortgage closing.

eight. Residential property Restrictions

USDA mortgage loans commonly meant to financing farms or highest acreage properties. Rather, he could be geared toward the high quality single-home. It is possible to financing specific condos and you can townhomes to your program.

8. No. 1 Home Criteria

Belongings being ordered have to be the majority of your house, meaning you intend to reside indeed there to your near future. Rental properties, investment characteristics, and you may 2nd house commands are not eligible for this new USDA financial financing system.

nine. Mortgage Dimensions by Income

There are not any stated mortgage restrictions to possess USDA mortgages. Alternatively, an enthusiastic applicant’s money identifies the maximum mortgage proportions. The brand new USDA earnings restrictions, upcoming, ensure sensible financing types for the program. Income of all the loved ones 18 years of age and elderly don’t exceed USDA guidelines right here.

ten. Installment Feasibility

Your generally you prefer a beneficial 24-few days history of reliable a job so you’re able to qualify, plus sufficient earnings away from said a job. But not, education from inside the a related industry normally replace certain or each of you to definitely sense demands. Their bank should determine fees feasibility.

USDA’s mandate will be to promote homeownership within the low-urban areas. As a result, it will make its loan sensible so you’re able to a larger spectral range of house people by continuing to keep prices and fees reasonable.

Find out more about the many benefits of good USDA home mortgage and coping with your neighborhood society bank. Correspond with one of the home mortgage masters in the Chelsea County Lender. Get in touch with our work environment because of the cell phone: 734-475-4210 otherwise on the internet.