Loan Term Revelation

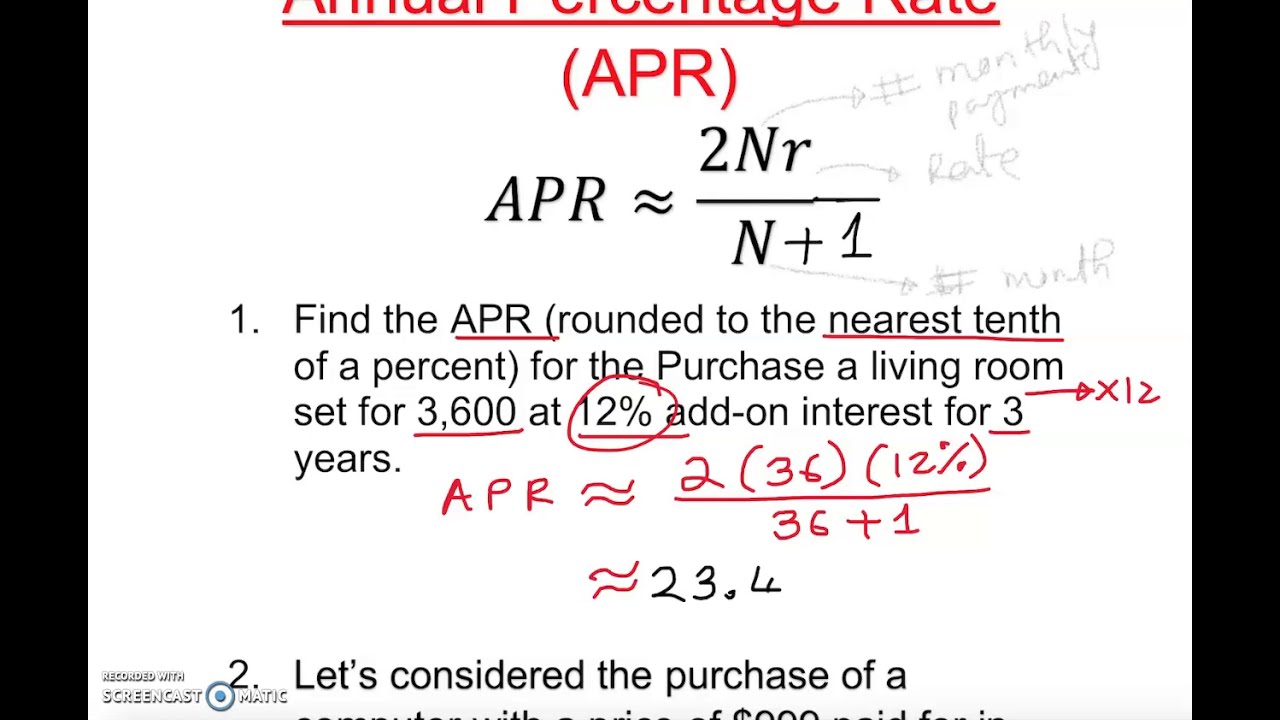

Your loan conditions, plus ount, title duration, as well as your credit profile. Excellent borrowing from the bank is required to qualify for reasonable cost. Speed is actually cited with AutoPay discount. AutoPay disregard is readily available just before mortgage financing. Pricing in place of AutoPay is actually 0.50% facts highest. At the mercy of borrowing from the bank acceptance. Criteria and you will constraints incorporate. Said cost and you will conditions is at the mercy of change without warning. Payment example: Monthly obligations to have an effective $twenty five,000 financing during the eight.49% Apr having a term from 36 months manage end up in thirty-six monthly obligations off $. 2024 Truist Monetary Firm. Truist, LightStream in addition to LightStream representation is services scratching away from Truist Financial Business. Any kind of trademarks could be the possessions of their particular people. Lending features available with Truist Financial.

Pricing Revelation

Repaired cost away from 8.99% Apr to help you % Apr echo brand new 0.25% autopay interest rate dismiss and a great 0.25% lead put interest write off. SoFi rates selections is actually newest at the time of and therefore are at the mercy of change with no warning. The common away from SoFi Personal loans financed when you look at the 2022 is around $30K. Not totally all individuals qualify for a minimal price. Lowest pricing set aside for creditworthy borrowers. Their genuine speed could well be inside the a number of cost listed and certainly will believe the definition of you choose, testing of your creditworthiness, money, and you can different other variables. Mortgage quantity are priced between $5,000 $100,000. The fresh Apr ‘s the cost of credit as a yearly rates and shows one another their interest rate and you can an bad credit installment loans Maine origination fee out of 0%-7%, that’s deducted out-of one loan continues you get. Autopay: The fresh new SoFi 0.25% autopay rate of interest avoidance means one to agree to create monthly prominent and you will focus costs by an automated month-to-month deduction away from an effective coupons otherwise bank account. The main benefit usually cease and start to become destroyed to own symptoms where that you don’t pay because of the automatic deduction from a savings otherwise savings account. Autopay is not needed for that loan from SoFi. Direct Deposit Dismiss: As permitted potentially located a supplementary (0.25%) interest rate prevention to have starting head deposit which have a good SoFi Checking and you will Family savings offered by SoFi Financial, Letter.A. or eligible dollars management account supplied by SoFi Securities, LLC (Direct Put Membership), you really must have an unbarred Direct Deposit Account in this 1 month of your own financial support of the Financing. Immediately after eligible, you are going to discovered which write off throughout episodes for which you possess allowed payroll lead deposits with a minimum of $step 1,000/few days to help you a direct Deposit Account prior to SoFi’s practical steps and requirements to get determined within SoFi’s sole discretion. So it dismiss would be forgotten while in the episodes where SoFi identifies you really have turned-off head deposits toward Direct Deposit Membership. You aren’t required to join direct deposits to receive financing.

Arrived at Economic: Good for merging obligations punctual

- Loans available to your creditors within 24 hours out-of mortgage approval

- Access to the free month-to-month credit score

- Some of the reduced carrying out prices in the business

- Money is only able to be used having combining financial obligation

- May charge an initial origination fee

- Cannot sign up for that loan with another individual

What to understand

Come to Monetary even offers personal loans created specifically getting debt consolidation reduction and credit card refinancing. The starting costs was competitive, and you will Come to sends the bucks for the financial institutions within 24 hours out-of mortgage approval. You will rating totally free monthly accessibility your credit score.

You can save cash on the loan for many who qualify for Reach’s reduced creating pricing, however, keep an eye out getting an origination percentage – Arrive at charges as much as 8.00% of amount borrowed up front.