Specific no-credit-have a look at lenders be credible than others, regardless if. You’ll be able to Loans, such as for instance, enjoys APRs around 200%, it now offers 29-big date forbearance solutions if you find percentage products.

Ideas on how to improve your credit score

Renovations aside, focusing on your credit rating pays no matter what an immediate significance of borrowing from the bank. It will enables you to take advantage of ideal cost and you will words, and make resource sales otherwise ideas a whole lot more down and you can sensible.

If you’re able to delay your home developments for most weeks, you are able to increase your credit rating enough to alter your odds of acceptance and you can a diminished interest.

- Request and you can remark a copy of one’s credit report, guaranteeing the information is legitimate and you can contesting anything that looks wrong otherwise wrong.

- Spend your own costs punctually, anytime.

- Reduce your borrowing utilization by paying down obligations.

- Use handmade cards responsibly. Handmade cards is also change your credit because of the improving the complete borrowing supply, but only when you retain your own balances low and you can pay into the time.

Usually when anyone relate to protected finance if you have crappy borrowing from the bank, it explore pay day loan or title loans. Such different credit is going to be hazardous, and in addition we do not suggest together.

That is because they arrive which have sky-large rates of interest-will triple-digit-and want one to play with worthwhile information such as your salary otherwise automobile once the guarantee.

When you have bad credit, getting cautious with your own recognition chance having a classic financial are understandable. However, it is really not really worth then jeopardizing your financial coverage. Ahead of turning to guaranteed-acceptance money, mention your options having loan providers offering more reasonable conditions.

Must i get back home improve financing having bad credit no collateral?

Do-it-yourself fund try unsecured unsecured loans plus don’t want their house security because equity. As the home improvements are not covered, getting accepted utilizes additional factors, just like your credit score, financial obligation, income, and you will amount borrowed.

Exactly what credit rating do i need to score a house update loan?

Many loan providers try not to indicate the absolute minimum credit score however, emphasize one debt, earnings, credit history, and you may loan amount are essential on their credit algorithms.

Upstart, for example, doesn’t condition at least score. Up-date accepts results down to 560, and you can Reliable also offers funds to have consumers with 550 scores and you will over.

Simply how much ought i borrow to have a house upgrade financing?

For each financial possess book financing standards getting approval. You could essentially acquire up to your debt-to-earnings ratio (DTI) often manage you, as much as this new lender’s restrict.

Particular loan providers cover its financing amounts, no matter good borrower’s borrowing reputation and you can DTI. If you need a more impressive do it yourself mortgage, prioritize loan providers having large limitation fund otherwise research Credible to have loan providers having high mortgage limitations.

How much cash more expensive try a house improve financing having crappy credit than good credit?

Property upgrade mortgage can cost many even more when you yourself have less than perfect credit. If you have good credit, money terms and conditions are more advantageous and you can help save you extreme currency.

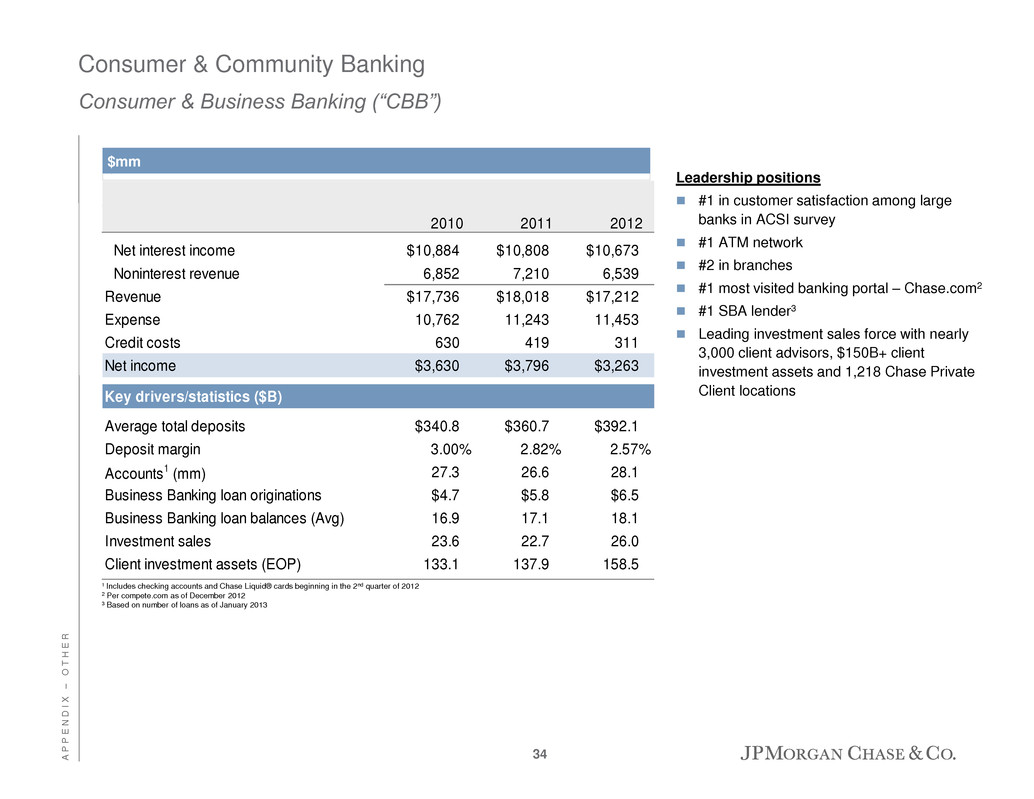

Thought a great $10,000 do it yourself loan that have five-year terms and conditions. Have a look at desk lower than to see just how their borrowing pricing change dependent on the Annual percentage rate:

It’s clear simply how much more expensive financing with high Annual Midway payday loans percentage rate is. Note that you’ll save thousands of dollars during the desire as compared to preserving doing purchase an excellent $ten,000 bucks do it yourself.

How to choose a home improve financing which have bad credit

- Waiting to listen out of your financial. Certain lenders give quick approvals, although some may take a business day or two provide your a decision.

For example, no-credit-check money usually are full having charges. Rates of interest are going to be substantial, also. One to combination will make it almost impossible to settle your loan instead of providing swept up within the a financial obligation course.