The score by Finanso relies upon all of our article people. The newest scoring formula has a monetary unit types of as well as tariffs, charges, perks and other solutions.

The new rating from the Finanso varies according to all of our editorial party. This new rating algorithm includes a monetary product particular and tariffs, charges, rewards or other choice.

The fresh rating from the Finanso is dependent on our very own editorial people. New rating formula has a monetary equipment sorts of and additionally tariffs, charge, benefits or other selection.

Play with the online calculator to track down facts on you can easily loan amounts, interest rates, and you will repayment times. It is a vital equipment for your financing need.

In the us, personal loans is judge and generally speaking employed for low-business requires. They have to be paid off according to mortgage arrangement, which has desire and you can a cost schedule. Individuals statutes manage this type of funds, such as the Equivalent Borrowing Opportunity Operate , the newest Fair Debt collection Techniques Work , therefore the Facts from inside the Financing . Such rules cover both lender’s passion therefore the borrower’s liberties, making certain fairness and openness in the lending processes.

Preciselywhat are Huntington Bank loans?

Whether you’re thought a home lso are relationship, otherwise you would like financial help to possess a life threatening costs, custom money out-of Huntington Bank normally fit your preferences. When you’re burdened with a high-focus personal debt, a consumer loan could also be used to own debt consolidation reduction. Learn more about the products and you can conveniently use online or perhaps in individual.

Has actually

- Competitive Personal bank loan Prices. Huntington brings aggressive unsecured loan pricing, making sure certified customers receive good rates of interest one remain fixed during the borrowed funds term. This new unsecured unsecured loan rate of interest diversity try 8.97%-% Apr. Put secured unsecured loan rate of interest range try 8.26%-% Annual percentage rate.

- Flexible Commission Possibilities. For added comfort, consumers feel the self-reliance to determine the date of their earliest commission, permitting a screen as much as two months shortly after closure the borrowed funds.

- Flexible Terms and conditions. To advance match individual economic factors, Huntington support users in choosing that loan label you to definitely aligns that have their budgetary needs, getting in balance money.

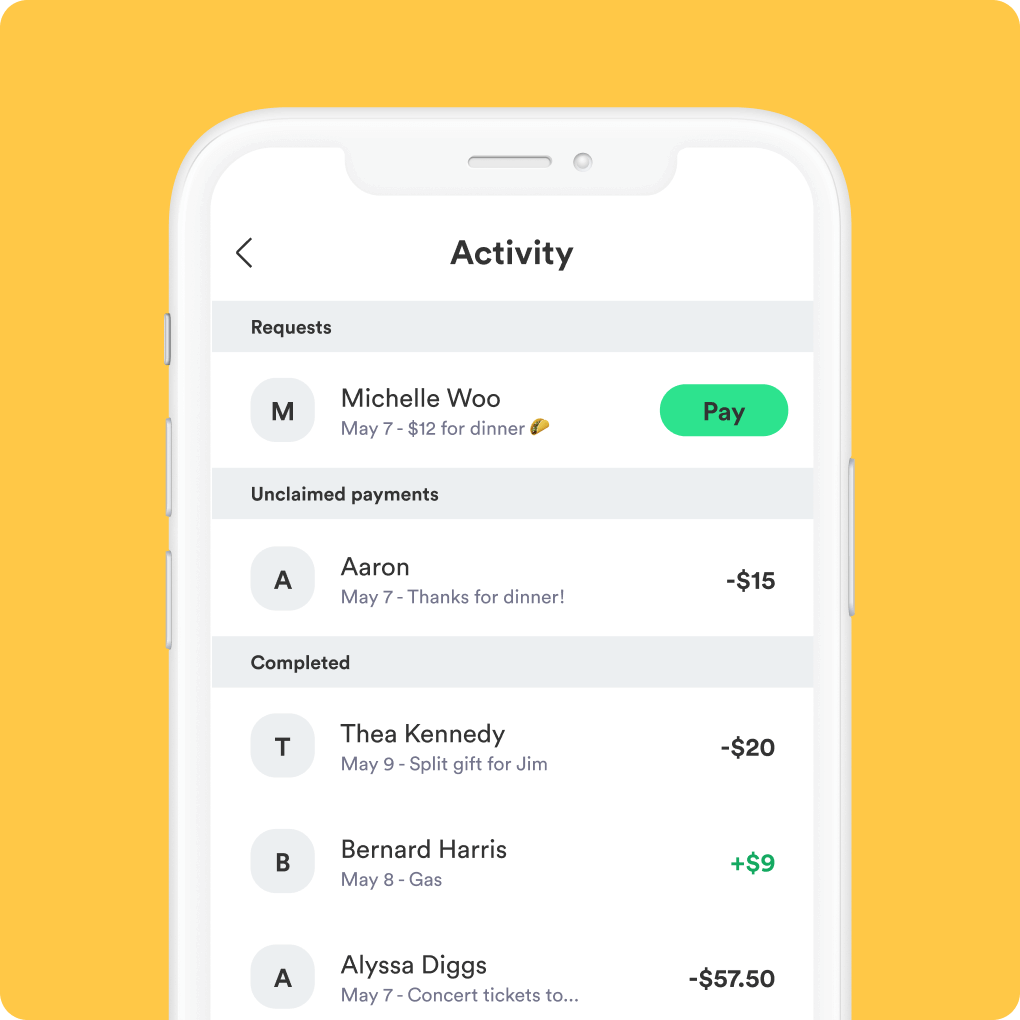

- On the internet Account Administration. With on the web membership management, people can save dedication. They can effortlessly take a look at its loan equilibrium, song deal record, and you may conveniently create money from the digital platform because of the accessing the personal loan account on the internet. That it streamlined processes enhances convenience and you can installment loans online CA results to have borrowers.

Huntington Financial Unsecured loan Possibilities

In the Huntington, people have access to multiple personal loan options. The newest unsecured personal loan choice lets people to see financing based on their credit report, because the safeguarded personal bank loan option is partially in line with the value of individual assets. It flexibility permits individuals to determine the mortgage sort of you to definitely aligns most readily useful with their economic conditions.

Unsecured Personal loans

For those trying an unsecured consumer loan, it can be utilized for different purposes like family repairs, medical expenses, debt consolidating, and. Moreover, opting for that it mortgage types of can potentially remove monthly premiums and you can spend less across the loan’s period. Qualification because of it loan varies according to things such as borrowing score, debt-to-earnings proportion, or other monetary factors. Based being qualified affairs, borrowers can access as much as $fifty,000 with a fixed rate of interest and versatile payment possibilities.

Secured finance

The brand new put-secure personal bank loan alternative provides the advantageous asset of straight down interest rates as it is supported by guarantee. Which loan allows people to fund personal expenses, benefit from faster rates of interest, take care of their coupons needs, and you can on the other hand build their credit owing to consolidated monthly premiums. Huntington accepts collateral as the a great Huntington Certificate out-of Put (CD), Huntington Family savings, or Huntington Currency Field Membership. Toward put-secure mortgage, consumers can potentially use around the value of its put, and that’s as much as $five-hundred,000, while you are experiencing the capability of consolidated monthly installments.